The outlook for India by the World Bank has been lifted its GDP growth forecast to 6.9%, after having lowering it to 6.5% in October 2022. India's economy has been remarkably resilient to the deteriorating external environment vis-à-vis geo political developments, high inflation and slowing economic growth in many economies. The strong macroeconomic fundamentals have placed it in good stead compared to other emerging market economies. The pace of economic activity showed momentum on the back of strong demand side, supply side and investments supported by the various structural reforms undertaken by the Government during the last 3 years or since the pandemic knocked down the normal growth trajectory of Indian economy in 2020.

In the recent economic developments, most importantly, the inflation trajectory for the WPI and CPI has come down significantly at 5.8% and 5.9% respectively in November 2022 as compared to 8.4% and 6.8% respectively in October 2022. The CPI inflation for rural and urban for the month of November 2022 is 6.1% and 5.6% respectively. The decline in rate of inflation in November, 2022 is primarily contributed by fall in prices of food articles, basic metals, textiles, chemicals & chemical products and paper & paper products as compared to the corresponding month of the previous year.

Source: PHD Research Bureau, PHDCCI, compiled from the office of the Economic Advisor, Government of India

Inflation, though not yet in the target trajectory of the RBI, still giving a respite to consumers and producers as high inflation is not in favour of any, consumers and producers; it reduces the price cost margins of the producers via-a-vis high costs of raw materials and impacts the consumers purchasing power due to price increases.

The combined Index of Eight Core Industries increased by 0.1 % in October 2022 as compared to the Index of October 2021. The production of Fertilizers, Steel, Coal and Electricity generation increased in October 2022 over the corresponding month of last year. This needs a serious attention as infrastructure development in the country is one of the most important ingredients to achieve the vision of Atamanirbhar bharat. Front loading of the allocations made in the National Infrastructure Pipeline and to speed up the projects through Gati Shakti would be crucial to enhance the infrastructure growth in the country. On the other hand, growth in industry output, as measured in terms of IIP, for the month of October 2022 stands at (-)4% as compared to 3.5% in September 2022. The overall IIP for the period Apr-Oct is 5.3%.

Source: PHD Research Bureau, PHDCCI, compiled from the Ministry of Commerce and Industry. Note:* Provisional.

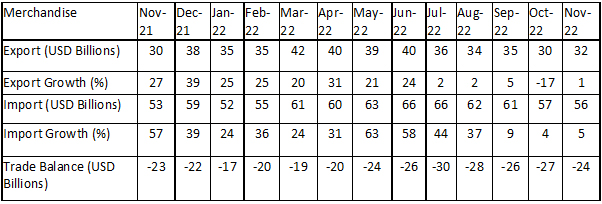

Merchandise exports for the month of November 2022 stood USD 31.99 Billion whereas, imports mounted to USD 55.88 billion. Merchandise exports for the month of November 2022 grew by 0.59% whereas; imports grew by 5.37% as compared to November 2021. Trade balance during the month is estimated at (-) USD 23.89 billion. Trend in the merchandise exports growth in the recent months is slowing down as compared with the Apr-June growth of merchandise exports.

Source: PHD Research Bureau, PHDCCI, Compiled from Ministry of Commerce and Industry, GOI

Service exports for the month of November 2022 are estimated at USD 26.23 billion and imports at USD 13.44 billion showing surplus of USD 12.79 billion. Overall trade balance for November 2022 is estimated at (-) USD 11.11 billion as compared to the (-) USD 13.19 billion in November 2021. Trend in services exports remain intact with a consistent growth trajectory. On the supply side, the gross GST revenue collected in the month of November 2022 is ? 1,45,867 crore is 11% higher than the GST revenues collected in the same month last year. Policy environment in the country remains attractive as the sequential growth of SENSEX (average of daily close) has shown M-o-M growth of 5.0 percent in November 2022 as compared to its corresponding value in October 2022.

Source: PHD Research Bureau; PHDCCI Compiled from Ministry of Commerce and Industry, Government of India

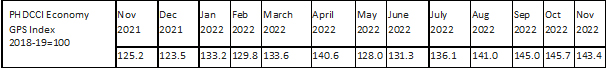

The PHDCCI Economy GPS Index for November 2022 remained steady to 143.4 as compared to 145.5 in October 2022, 145.0 in September 2022, and 141.0 in August due to buoyancy in consumption patterns and softening inflation. PHDCCI Economy GPS Index captures the momentum in supply side business activity through growth in GST collections, demand side consumer behaviour through volume growth in passenger vehicle sales and sensitivity of policy reforms and impact of domestic and international economic and business environment through the movement of SENSEX at the base year of 2018-19=100.

Demand trajectory in the economy remains intact as passenger vehicles, with compact cars and utility vehicles, grew 3,10,580 in November 2022 from 2,15,626 in November 2021 marking a whooping 44% Y-o-Y growth as compared to November 2021. Supply side indicator, GST, is showing robust performance, policy environment in the country remains attractive as the sequential growth of SENSEX (average of daily close) has shown M-o-M growth of 5% in November 2022 as compared to its corresponding value in October 2022. Foreign exchange reserves are significantly higher at USD 561 billion as compared with the pre covid levels of USD 447 billion in 2019-20.

Source: PHD Research Bureau, PHD Chamber of commerce and Industry

Overall, the growth trajectory has become strong as compared with the pre covid levels. Economic activity of the foregoing months has shown steady momentum on the back of positive consumer demand and diminishing global economic uncertainties. Plethora of meaningful economic reforms announced by the Government in last three years has strengthened the drivers of economic growth. The inflation challenge has subsided significantly in the recent months, though slowly.

Going ahead, the economic growth trajectory at this juncture must be supported with enhanced consumption and conducive investment environment vis-à-vis ease of doing business in the country. The enhanced consumption activity will increase capacity utilisation in the factories and boost sentiments of the producers for capacity expansions. Calibrated steps to enhance domestic sources of growth would be crucial to maintain the steady economic growth trajectory. The recent RBI initiative of introducing digital currency has the potential to transform the settlement systems for Financial transitions undertaken by banks in G-sec segment, interbank-market, and capital market more efficient and secure as well.

In a nutshell, it seems that economic growth will surpass 7% in the current financial year supported by the resilient demand conditions and improved supply side. RBI recently started slowing the rate hikes with a hike by only 35 basis points to 6.25% in order to control retail inflation and maintain economic growth, Going ahead, continued hand holding by the Government is required to mitigate the impact of recent geo-political developments while maintaining a balance between inflation and economic growth.

(Dr. S.P. Sharma is Chief Economist & Director of Research • PHDCCI (PHD Chamber of Commerce and industry, India)

Disclaimer: The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of Indiastat and Indiastat does not assume any responsibility or liability for the same.

From Factoring to Green Bonds - Strategic Insights into India's Trade Finance and Export Ecosystem... Read more